A Deep Dive into the Online 1040-ES Form

When it comes to individual tax responsibility, the United States operates under a "pay-as-you-go" system. Taxpayers who earn income not subject to withholding, such as earnings from self-employment, interest, dividends, rent, or alimony, are required to make estimated tax payments. This is where Form 1040-ES, the Estimated Tax for Individuals, plays a fundamental role. The document includes a worksheet that aligns closely with the more comprehensive Form 1040. It helps taxpayers calculate and pay their estimated taxes quarterly, which is essential to avoid penalties for underpayment.

Advantages of the Fillable Online 1040-ES

Filling out Form 1040-ES online offers significant advantages due to its interactive nature. The structured fillable form often includes intuitive fields that guide users through complex tax situations, making it easier to understand necessary information. Utilizing the fillable version helps minimize errors as calculations are generally automated, helping to ensure the accuracy of the taxes owed. Additionally, the convenience of saving and editing the document on a computer simplifies record-keeping for the user.

Challenges in Online Filing

Submitting forms online can be met with a few hurdles. For instance, taxpayers who prefer to file Form 1040-ES online may encounter technical difficulties, such as incompatible web browsers or software issues that could preclude the proper procession of their tax forms. Navigational difficulties in the electronic interface may also confuse less tech-savvy users. Furthermore, internet glitches or server outages can disrupt the submission process and lead to filings that are not properly registered.

Successful Online Filing Guidelines

- To ensure a successful experience with federal 1040-ES online filing, begin by gathering all necessary documentation, such as the previous year's tax returns, current year's income statements, and deductions.

- Then, visit a trusted website or utilize the official services to access the form.

- Read the instructions carefully and complete each section accurately.

- Double-check calculations and details before submission.

- Finally, make note of confirmation numbers or electronic receipts as proof of your submitted payment.

Protecting Your Personal Data

When dealing with sensitive financial data, safeguarding personal information is paramount, particularly when using a 1040-ES for online filing.

- Start by ensuring that your computer is protected with up-to-date antivirus software.

- Use strong, unique passwords for tax-related accounts and enable two-factor authentication wherever possible.

- Ensure the security of your internet connection—avoid public Wi-Fi for financial transactions—and always log out from tax websites immediately after completing your tasks.

- Keeping copies of all documents and confirming that the website is secure (look for 'https' in the URL) is also essential for protecting your personal information.

Submitting Form 1040-ES online can indeed streamline estimated tax payments effectively. By taking advantage of the convenience it offers and observing the guidelines for safe filing, taxpayers can manage their estimated taxes with greater confidence and precision.

Related Forms

-

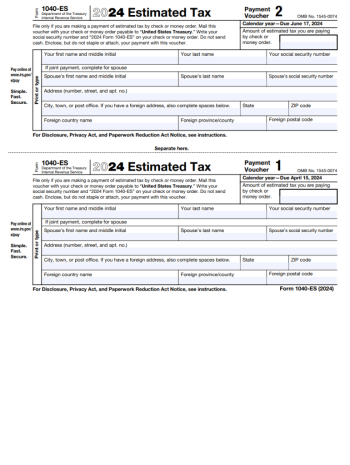

![image]() 1040-ES IRS Form 1040-ES is a critical document for individuals who need to pay estimated taxes on income that is not subject to withholding, such as earnings from self-employment, interest, dividends, rents, or alimony. The form includes instructions for calculating quarterly estimated tax payments, ensuring taxpayers comply with the Internal Revenue Code, and avoiding potential penalties for underpaying taxes. Proper understanding and use of IRS Form 1040-ES with instructions are pivotal for managing... Fill Now

1040-ES IRS Form 1040-ES is a critical document for individuals who need to pay estimated taxes on income that is not subject to withholding, such as earnings from self-employment, interest, dividends, rents, or alimony. The form includes instructions for calculating quarterly estimated tax payments, ensuring taxpayers comply with the Internal Revenue Code, and avoiding potential penalties for underpaying taxes. Proper understanding and use of IRS Form 1040-ES with instructions are pivotal for managing... Fill Now -

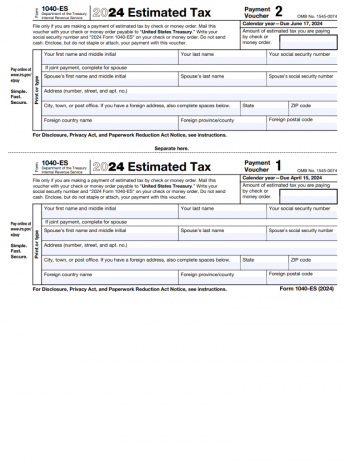

![image]() Printable IRS Form 1040-ES The IRS Form 1040-ES is designed to assist taxpayers in calculating and paying their estimated taxes every quarter. For individuals who do not have taxes withheld from their earnings or for those whose withholding is not sufficient, this document is crucial in avoiding underpayment penalties. Presenting a layout with distinct sections for your income details, deductions, and credits, the IRS Form 1040-ES printable helps estimate the amount of tax owed for the year. The 1040-ES Printable Form Structure The core sections of the 2024 tax form 1040-ES printable you'll need to focus on include: Estimated income for the year, which requires you to know your expected adjusted gross income, taxable income, taxes, deductions, and credits. Figuring your estimated tax, taking into account the Alternative Minimum Tax and self-employment tax if applicable. Calculating estimated tax payments to know how much to pay for each quarter. Step-by-Step Instructions on Filling Out Form 1040-ES Begin with your total expected gross income for the year, including all sources of income. Subtract any adjustments to income to arrive at your expected adjusted gross income. Factor in deductions to calculate your estimated taxable income. Utilize the Tax Rate Schedules provided with the form to estimate the federal tax you'll owe. Consider any self-employment tax if you are self-employed. Calculate any credits you anticipate to claim throughout the year. Determine the total estimated tax due and divide this figure by four to get your quarterly payment amount. Proper Submission of Form 1040-ES To appropriately submit the printable IRS Form 1040-ES in 2024, ensure you have accurately calculated your estimated payments. Once filled out, you can send your payment to the IRS along with the Form 1040-ES voucher associated with the specific quarter. Make sure to mail it to the proper address corresponding to your state, which can be found in the instructions provided with the printable Form 1040-ES. Alternatively, you can also make these payments electronically using the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS). Due Dates for Submitting the 2024 Tax Form 1040-ES Adherence to deadlines is paramount when dealing with estimated tax payments. For the fiscal year 2024, you should be aware of these critical dates: 1st Payment: April 15, 2024 2nd Payment: June 16, 2024 3rd Payment: September 15, 2024 4th Payment: January 15, 2025 Should any of these dates fall on a weekend or public holiday, the due date would then be the following business day. Our website stands as a trustworthy resource from which you can easily obtain and print the 1040-ES form. With a clear understanding of the form's structure, meticulous adherence to the step-by-step instructions provided, and awareness of the submission deadlines, managing your quarterly tax payments should be hassle-free. Fill Now

Printable IRS Form 1040-ES The IRS Form 1040-ES is designed to assist taxpayers in calculating and paying their estimated taxes every quarter. For individuals who do not have taxes withheld from their earnings or for those whose withholding is not sufficient, this document is crucial in avoiding underpayment penalties. Presenting a layout with distinct sections for your income details, deductions, and credits, the IRS Form 1040-ES printable helps estimate the amount of tax owed for the year. The 1040-ES Printable Form Structure The core sections of the 2024 tax form 1040-ES printable you'll need to focus on include: Estimated income for the year, which requires you to know your expected adjusted gross income, taxable income, taxes, deductions, and credits. Figuring your estimated tax, taking into account the Alternative Minimum Tax and self-employment tax if applicable. Calculating estimated tax payments to know how much to pay for each quarter. Step-by-Step Instructions on Filling Out Form 1040-ES Begin with your total expected gross income for the year, including all sources of income. Subtract any adjustments to income to arrive at your expected adjusted gross income. Factor in deductions to calculate your estimated taxable income. Utilize the Tax Rate Schedules provided with the form to estimate the federal tax you'll owe. Consider any self-employment tax if you are self-employed. Calculate any credits you anticipate to claim throughout the year. Determine the total estimated tax due and divide this figure by four to get your quarterly payment amount. Proper Submission of Form 1040-ES To appropriately submit the printable IRS Form 1040-ES in 2024, ensure you have accurately calculated your estimated payments. Once filled out, you can send your payment to the IRS along with the Form 1040-ES voucher associated with the specific quarter. Make sure to mail it to the proper address corresponding to your state, which can be found in the instructions provided with the printable Form 1040-ES. Alternatively, you can also make these payments electronically using the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS). Due Dates for Submitting the 2024 Tax Form 1040-ES Adherence to deadlines is paramount when dealing with estimated tax payments. For the fiscal year 2024, you should be aware of these critical dates: 1st Payment: April 15, 2024 2nd Payment: June 16, 2024 3rd Payment: September 15, 2024 4th Payment: January 15, 2025 Should any of these dates fall on a weekend or public holiday, the due date would then be the following business day. Our website stands as a trustworthy resource from which you can easily obtain and print the 1040-ES form. With a clear understanding of the form's structure, meticulous adherence to the step-by-step instructions provided, and awareness of the submission deadlines, managing your quarterly tax payments should be hassle-free. Fill Now -

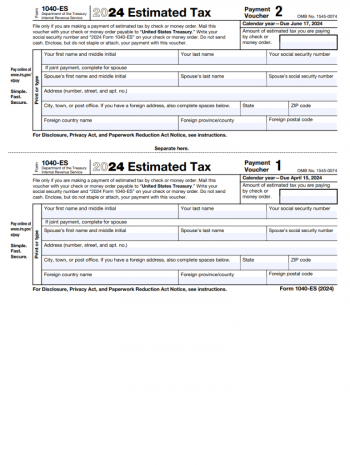

![image]() 1040-ES Estimated Tax Form The IRS Form 1040-ES is designed for taxpayers to calculate and pay estimated taxes on income that is not subject to withholding. Estimated taxes may apply to income from self-employment, interest, dividends, alimony, rent, and gains from the sale of assets, as well as taxable unemployment and Social Security benefits. The form helps to determine the amount of estimated tax you are required to pay and provides vouchers used to submit quarterly estimated tax payments. Ensuring you are knowledgeable about estimated taxes and confident in how to utilize the 1040-ES estimated tax form for 2023 is crucial for maintaining compliance with your tax responsibilities and avoiding unnecessary penalties and interest. Exceptions of Federal Tax Form 1040-ES Although IRS Form 1040-ES for estimated tax is an essential tool for many taxpayers, certain individuals may not need to use it. This typically includes those whose employer withholds taxes on their behalf or individuals who do not meet the threshold requirements for making estimated tax payments. Additionally, nonresident aliens and those with unique tax situations, such as individuals with a fiscal tax year, might not use this form. They should consult a tax professional or IRS guidelines specific to their circumstances. Applying IRS Tax Form 1040-ES: A Hypothetical Scenario Imagine Jane Doe, a freelance graphic designer, recently embarked on a business venture. Jane expects to earn $50,000 this year, but since she's self-employed, there's no employer to withhold taxes from her paycheck. Using the estimated tax form 1040-ES, Jane calculates her estimated tax payments for the year. By dividing this total estimate into four payments, she avoids an underpayment penalty and possible interest charges by paying her taxes in “installments” throughout the year. Common Challenges and Solutions with Form 1040-ES Common Issue Solution Unsure how to calculate estimated taxes Utilize the worksheet provided in Form 1040-ES, which helps estimate your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. Missed a deadline for quarterly payment Make the payment as soon as possible to minimize penalties and interest; consider adjusting your next payment to cover the shortfall. Inconsistent income makes it difficult to estimate If your income varies, consider using the annualized income installment method detailed in the instructions for Form 1040-ES. Lost the payment voucher You can make payments online through the IRS Direct Pay system or utilize the printable 1040-ES estimated tax form for 2023 for a replacement. For the most up-to-date information on making estimated tax payments and access to the 1040-ES estimated tax form printable version, you can use our website. Remember, proactive tax planning can lead to smoother financial management throughout the year. Taxpayers are encouraged to seek professional advice if they are unsure about their estimated tax obligations or how to navigate Form 1040-ES. Finally, for those who prefer to make their payments without using the mail, online payment options are available. Using the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS) could ensure timely payments and avoid lost vouchers. Fill Now

1040-ES Estimated Tax Form The IRS Form 1040-ES is designed for taxpayers to calculate and pay estimated taxes on income that is not subject to withholding. Estimated taxes may apply to income from self-employment, interest, dividends, alimony, rent, and gains from the sale of assets, as well as taxable unemployment and Social Security benefits. The form helps to determine the amount of estimated tax you are required to pay and provides vouchers used to submit quarterly estimated tax payments. Ensuring you are knowledgeable about estimated taxes and confident in how to utilize the 1040-ES estimated tax form for 2023 is crucial for maintaining compliance with your tax responsibilities and avoiding unnecessary penalties and interest. Exceptions of Federal Tax Form 1040-ES Although IRS Form 1040-ES for estimated tax is an essential tool for many taxpayers, certain individuals may not need to use it. This typically includes those whose employer withholds taxes on their behalf or individuals who do not meet the threshold requirements for making estimated tax payments. Additionally, nonresident aliens and those with unique tax situations, such as individuals with a fiscal tax year, might not use this form. They should consult a tax professional or IRS guidelines specific to their circumstances. Applying IRS Tax Form 1040-ES: A Hypothetical Scenario Imagine Jane Doe, a freelance graphic designer, recently embarked on a business venture. Jane expects to earn $50,000 this year, but since she's self-employed, there's no employer to withhold taxes from her paycheck. Using the estimated tax form 1040-ES, Jane calculates her estimated tax payments for the year. By dividing this total estimate into four payments, she avoids an underpayment penalty and possible interest charges by paying her taxes in “installments” throughout the year. Common Challenges and Solutions with Form 1040-ES Common Issue Solution Unsure how to calculate estimated taxes Utilize the worksheet provided in Form 1040-ES, which helps estimate your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. Missed a deadline for quarterly payment Make the payment as soon as possible to minimize penalties and interest; consider adjusting your next payment to cover the shortfall. Inconsistent income makes it difficult to estimate If your income varies, consider using the annualized income installment method detailed in the instructions for Form 1040-ES. Lost the payment voucher You can make payments online through the IRS Direct Pay system or utilize the printable 1040-ES estimated tax form for 2023 for a replacement. For the most up-to-date information on making estimated tax payments and access to the 1040-ES estimated tax form printable version, you can use our website. Remember, proactive tax planning can lead to smoother financial management throughout the year. Taxpayers are encouraged to seek professional advice if they are unsure about their estimated tax obligations or how to navigate Form 1040-ES. Finally, for those who prefer to make their payments without using the mail, online payment options are available. Using the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS) could ensure timely payments and avoid lost vouchers. Fill Now -

![image]() IRS 1040-ES Form Understanding the 1040-ES IRS form is crucial for taxpayers who may need to plan ahead for their tax obligations. This form serves as an instrument for calculating and paying estimated taxes on income that is not subject to withholding. Such income may include earnings from self-employment, interest, dividends, rents, alimony, or certain prizes and awards. The purpose behind making these quarterly payments is to comply with the "pay-as-you-go" tax system employed by the United States, which obliges individuals to pay taxes on income as it is earned or received during the year. Recent Changes to the IRS 1040-ES Form In recent years, there have been alterations to both the filing rules and the structure of the 1040-ES form. These modifications reflect updates in tax legislation, inflation adjustments, and standard deductions. Most notably, changes in federal tax law, such as those introduced by the Tax Cuts and Jobs Act of 2017, have led to revisions in computation methods and potential deductions. Taxpayers must keep abreast of these updates annually to ensure compliance and accurate payment of estimated taxes. Eligibility for Using the Federal 1040-ES Form Not all taxpayers will need to submit the 1040-ES form to the IRS; this requirement primarily pertains to individuals who expect to owe $1,000 or more when their return is filed. Examples of eligible users include independent contractors, sole proprietors, and participants in partnerships. By contrast, employees who have taxes withheld from their paychecks typically do not need to fill out IRS Form 1040-ES unless they have other sources of income without withholding. Certain exemptions can apply: for instance, if you had no tax liability in the previous year, you might not be required to make estimated tax payments for the current year. Simplifying the Process of Filling Out IRS Form 1040-ES Begin with gathering all necessary documentation pertaining to your expected income for the year, including any potential deductions and credits. Utilize the IRS Form 1040-ES in PDF format, which can be reliably sourced from our website. This digital form can streamline the process and help prevent mistakes. Follow the instructions for IRS Form 1040-ES closely; these detailed guidelines provide step-by-step assistance in calculating estimated tax payments. Create a schedule to remind you of each quarterly due date: April 15, June 15, September 15, and January 15 of the following year. Consider using the Electronic Federal Tax Payment System (EFTPS) or other IRS-approved electronic options to submit your payments conveniently and securely. Always keep copies of your calculations and submitted forms for your records. As you can see, Form 1040-ES plays an essential role for those with income not subject to withholding, aiming to facilitate timely estimated tax payments. Staying updated with recent changes and utilizing available resources, such as a blank 1040-ES form in PDF from our website, can ensure a more manageable experience with tax responsibilities. Fill Now

IRS 1040-ES Form Understanding the 1040-ES IRS form is crucial for taxpayers who may need to plan ahead for their tax obligations. This form serves as an instrument for calculating and paying estimated taxes on income that is not subject to withholding. Such income may include earnings from self-employment, interest, dividends, rents, alimony, or certain prizes and awards. The purpose behind making these quarterly payments is to comply with the "pay-as-you-go" tax system employed by the United States, which obliges individuals to pay taxes on income as it is earned or received during the year. Recent Changes to the IRS 1040-ES Form In recent years, there have been alterations to both the filing rules and the structure of the 1040-ES form. These modifications reflect updates in tax legislation, inflation adjustments, and standard deductions. Most notably, changes in federal tax law, such as those introduced by the Tax Cuts and Jobs Act of 2017, have led to revisions in computation methods and potential deductions. Taxpayers must keep abreast of these updates annually to ensure compliance and accurate payment of estimated taxes. Eligibility for Using the Federal 1040-ES Form Not all taxpayers will need to submit the 1040-ES form to the IRS; this requirement primarily pertains to individuals who expect to owe $1,000 or more when their return is filed. Examples of eligible users include independent contractors, sole proprietors, and participants in partnerships. By contrast, employees who have taxes withheld from their paychecks typically do not need to fill out IRS Form 1040-ES unless they have other sources of income without withholding. Certain exemptions can apply: for instance, if you had no tax liability in the previous year, you might not be required to make estimated tax payments for the current year. Simplifying the Process of Filling Out IRS Form 1040-ES Begin with gathering all necessary documentation pertaining to your expected income for the year, including any potential deductions and credits. Utilize the IRS Form 1040-ES in PDF format, which can be reliably sourced from our website. This digital form can streamline the process and help prevent mistakes. Follow the instructions for IRS Form 1040-ES closely; these detailed guidelines provide step-by-step assistance in calculating estimated tax payments. Create a schedule to remind you of each quarterly due date: April 15, June 15, September 15, and January 15 of the following year. Consider using the Electronic Federal Tax Payment System (EFTPS) or other IRS-approved electronic options to submit your payments conveniently and securely. Always keep copies of your calculations and submitted forms for your records. As you can see, Form 1040-ES plays an essential role for those with income not subject to withholding, aiming to facilitate timely estimated tax payments. Staying updated with recent changes and utilizing available resources, such as a blank 1040-ES form in PDF from our website, can ensure a more manageable experience with tax responsibilities. Fill Now