All About Form 1040-ES and Estimated Tax Payments

IRS Form 1040-ES is a critical document for individuals who need to pay estimated taxes on income that is not subject to withholding, such as earnings from self-employment, interest, dividends, rents, or alimony. The form includes instructions for calculating quarterly estimated tax payments, ensuring taxpayers comply with the Internal Revenue Code, and avoiding potential penalties for underpaying taxes. Proper understanding and use of IRS Form 1040-ES with instructions are pivotal for managing your tax liability throughout the year.

Accessing a dedicated resource like 1040es-form.com can immensely simplify managing your estimated taxes. With comprehensive instructions, illustrative examples, and the ability to print the 1040-ES for 2023, our website is a valuable tool for taxpayers. It’s a must-have stop for those requiring clarity on completing and submitting their IRS 1040-ES tax form properly. The guidance provided can dispel confusion, help avoid common mistakes, and aid in making the necessary payments efficiently and correctly.

Table of Contents

Income Related to IRS Form 1040-ES

The 1040-ES form is a critical document for individuals anticipating owing taxes of $1,000 or more when their return is filed, especially for those who do not have taxes withheld from their income. This includes self-employed individuals, investors, retirees receiving dividends and interest, and anyone with other significant sources of taxable income not subject to withholding. To avoid penalties, they must fill out the 1040-ES form, calculate, and pay estimated taxes quarterly.

Let's Consider a Case

- Imagine Sarah, a freelance graphic designer whose thriving career has transformed from a side gig to her full-time job. As she's no longer on a company's payroll, taxes aren't being withheld from her income. Instead, Sarah must proactively manage her fiscal contributions by using the 1040-ES estimated tax form for 2023 to compute her quarterly payments. By accurately filling out the 1040-ES form, Sarah meets her tax obligations and avoids potential underpayment penalties.

- Keeping up with quarterly deadlines is crucial, so Sarah marks her calendar to remind herself when to get the 1040-ES form for each payment period. With these forms, she can estimate her earnings, determine the tax payable, and submit her payment online or by mail. This disciplined approach lets her focus on her clients rather than tax anxieties.

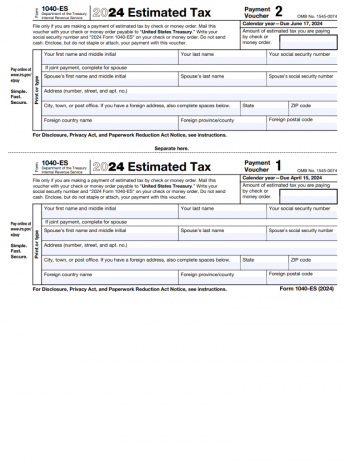

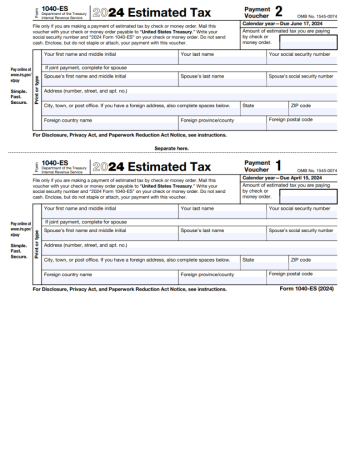

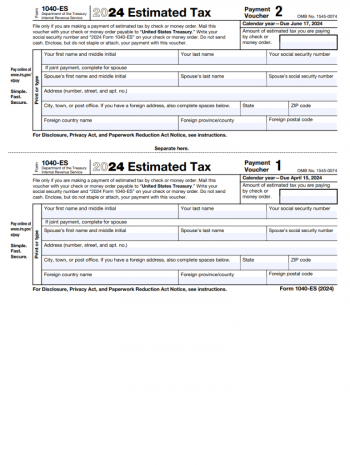

Instructions to Fill Out Blank 1040-ES Form in PDF

- Start by gathering your previous year's tax return and any relevant income and deduction records. This information serves as a foundation to calculate your estimated tax payments.

- Navigate to our website, where you can readily access the fillable 2024 1040-ES form for free. Make sure you're using the most current version for the applicable tax year.

- Read through the 1040-ES filing instructions carefully, which are conveniently provided to assist you in understanding each section and what information you are required to provide.

- Enter your personal information, including your name, address, and Social Security number, ensuring all details are accurate to prevent potential processing delays.

- Calculate your estimated tax liability using the provided worksheets that consider your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year 2023.

- Once you’ve filled out the form with the correct figures and details, recheck every field to catch any potential errors.

- After reviewing your entries, utilize our website's functionalities to either download the completed 2024 IRS Form 1040-ES for mailing or submit it online, following the available secure submission guidelines.

File Tax Form 1040-ES on Time

If you're self-employed or have other income that requires you to pay quarterly estimated taxes, the printable IRS 1040-ES form is crucial. It is typically due on April 15 for the first quarter. However, because this date marks the end of the fiscal year for the federal government, the deadline aligns with the need to account for income and payments within the same year.

Federal Form 1040-ES: Extra Tips

- While you can complete and file the 1040-ES online, the actual due dates for the remaining quarters do not fall squarely at the end of each quarter. Following April 15, the second, third, and fourth payments are due June 15, September 15, and January 15 of the following year, respectively. This schedule allows taxpayers to make payments as they earn income throughout the year.

- Should you find yourself unable to meet the April 15 deadline, the IRS does not typically grant extensions for estimated tax payments as they do with annual returns. Timely payment is expected to avoid potential penalties for underpayment. Ensure that your financial planning includes these important due dates to stay compliant with tax obligations.

IRS Tax Form 1040-ES & Nonresidents

Nonresident aliens who have to pay estimated taxes because they do not pay U.S. income tax through withholding, like self-employed individuals, often use Form 1040-ES(NR), "U.S. Estimated Tax for Nonresident Alien Individuals." For example, a foreigner living outside the U.S. but earning income from U.S. sources that is not subject to withholding would use Form 1040-ES(NR) to estimate and pay their taxes. It’s similar to the example of Form 1040-ES but tailored to the unique tax situations of nonresidents. Always refer to the current IRS guidelines or consult with an advisor to ensure compliance with the U.S. tax system.

1040-ES Tax Form: Popular Questions

- What is the IRS 1040-ES printable form, and who needs to use it?This document is used by individuals to estimate and pay their quarterly federal income tax. If you're self-employed or do not have taxes withheld from other sources of taxable income, such as dividends, rent, or alimony, you may need to make these payments to avoid penalties.

- How can I get the blank 1040-ES form?To obtain the blank template easily, visit our website and click the "Get Form" button. This will allow you to download the form at no cost, which you can then print and fill out with the necessary information.

- Can I use the 1040-ES sample for guidance when filling out the form?Yes, analyzing a filled-out example can prove incredibly useful for understanding how to accurately complete the report. Be aware, though, that you should use the sample solely for reference and ensure that your form is filled in with your own personal financial details.

- When should I use the 2024 1040-ES form printable?It should be used for estimating and paying your taxes annually. Typically, you'll make these estimated tax payments in four installments throughout the year to cover income that isn't subject to withholding.

- Why is it essential to file the federal tax form 1040-ES in 2024 correctly?Filing the federal 1040-ES report correctly is crucial to avoid any potential interest and penalties for underpayment of taxes. It ensures you stay compliant with the IRS regulations and maintain a good standing with the tax authorities.

Federal 1040-ES Form: More Guides for 2024

-

![image]() Printable IRS Form 1040-ES The IRS Form 1040-ES is designed to assist taxpayers in calculating and paying their estimated taxes every quarter. For individuals who do not have taxes withheld from their earnings or for those whose withholding is not sufficient, this document is crucial in avoiding underpayment penalties. Presen... Fill Now

Printable IRS Form 1040-ES The IRS Form 1040-ES is designed to assist taxpayers in calculating and paying their estimated taxes every quarter. For individuals who do not have taxes withheld from their earnings or for those whose withholding is not sufficient, this document is crucial in avoiding underpayment penalties. Presen... Fill Now -

![image]() Form 1040-ES Online When it comes to individual tax responsibility, the United States operates under a "pay-as-you-go" system. Taxpayers who earn income not subject to withholding, such as earnings from self-employment, interest, dividends, rent, or alimony, are required to make estimated tax payments. This is where Fo... Fill Now

Form 1040-ES Online When it comes to individual tax responsibility, the United States operates under a "pay-as-you-go" system. Taxpayers who earn income not subject to withholding, such as earnings from self-employment, interest, dividends, rent, or alimony, are required to make estimated tax payments. This is where Fo... Fill Now -

![image]() 1040-ES Estimated Tax Form The IRS Form 1040-ES is designed for taxpayers to calculate and pay estimated taxes on income that is not subject to withholding. Estimated taxes may apply to income from self-employment, interest, dividends, alimony, rent, and gains from the sale of assets, as well as taxable unemployment and Socia... Fill Now

1040-ES Estimated Tax Form The IRS Form 1040-ES is designed for taxpayers to calculate and pay estimated taxes on income that is not subject to withholding. Estimated taxes may apply to income from self-employment, interest, dividends, alimony, rent, and gains from the sale of assets, as well as taxable unemployment and Socia... Fill Now -

![image]() IRS 1040-ES Form Understanding the 1040-ES IRS form is crucial for taxpayers who may need to plan ahead for their tax obligations. This form serves as an instrument for calculating and paying estimated taxes on income that is not subject to withholding. Such income may include earnings from self-employment, interest... Fill Now

IRS 1040-ES Form Understanding the 1040-ES IRS form is crucial for taxpayers who may need to plan ahead for their tax obligations. This form serves as an instrument for calculating and paying estimated taxes on income that is not subject to withholding. Such income may include earnings from self-employment, interest... Fill Now